Receipt For Tax Deductible Donations

For the 2020 tax year theres a twist. To claim tax deductible donations on your taxes you must itemize on your tax return by filing Schedule A of IRS Form 1040 or 1040-SR.

Complete Guide To Donation Receipts For Nonprofits

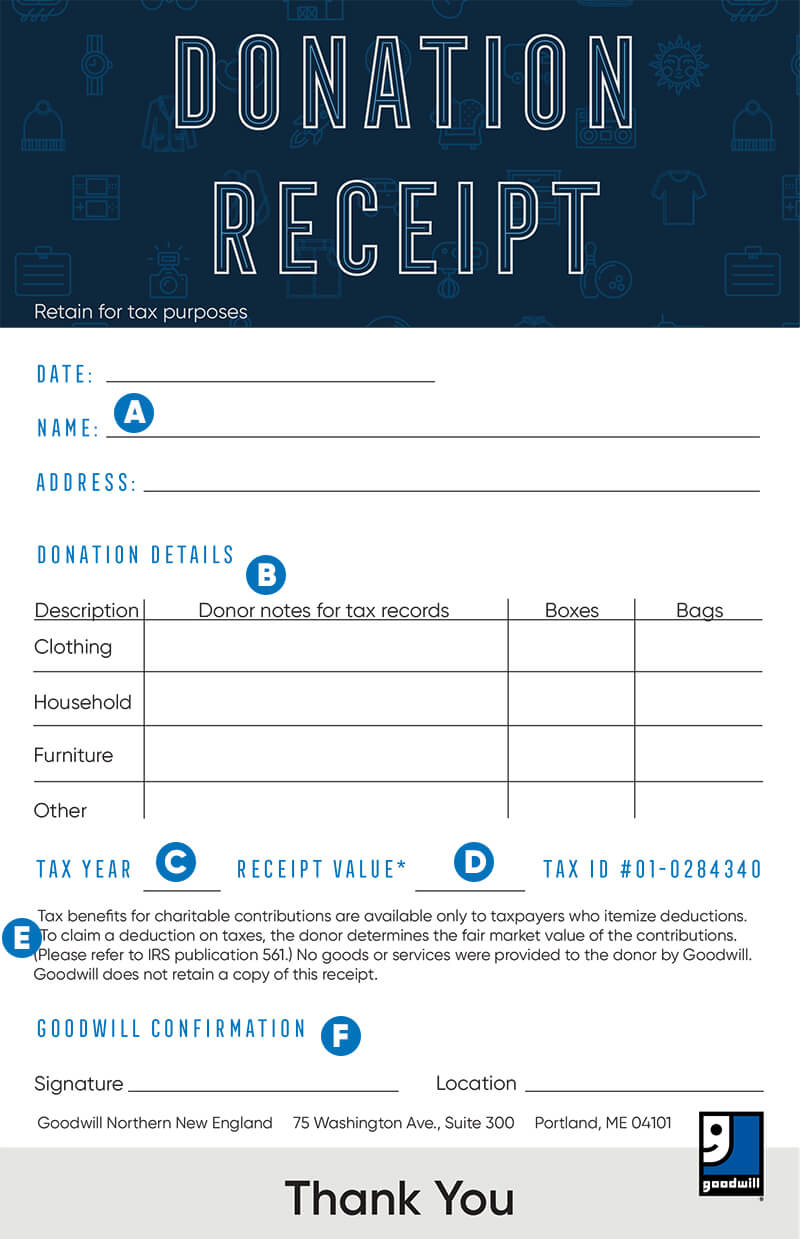

Tax-deductible receipts are crucial for a business organization and a professional that helps claim returns from the Internal Revenue Service.

. You do not need to claim the deduction in your tax form. A donation receipt is the first step toward showing your donor appreciation for what theyve done for your organization. In addition a donor may claim a deduction for contributions of cash check or other monetary gifts only if the donor maintains certain written records.

Build a Word Compatible Receipt Today - Export and Print Start For Free. Gifts of 2 or more. Ad Top Quality Legal Forms Packages of All Major.

Ad SDSU Missing Receipt Form More Fillable Forms Register and Subscribe Now. Is it a gift or contribution. This donation is tax deductible and the deduction will be automatically included in your tax assessment as you have provided your Tax Reference number eg.

If your total donations were more than your taxable income you can split your donations with your spouse or partner. To claim an endowment deduction without a receipt a donor must provide a bank record or a payroll-deduction record to claim tax deduction successfully. Donating under the.

Cash gifts of less than 250 are valid for donation deduction without a receipt. Ad Create Edit Print A Receipt For Word- Easy To Use Platform - Try Free Today. This organization is tax-exempt under IRS code 501 c 3 and your donations may be tax-deductible.

This includes a wide range of gifts including cash stock legal advice or in-kind. The total you can claim in a tax year is the lesser of. Generally property contributions are not included in this list.

Tax deductible donations can reduce taxable income. Ad Our site shows when receipts are sent viewed by your customer and accepted or declined. Property we value at more than 5000.

When donations are tax deductible the donation receipts issued by approved IPCs will indicate the words Tax-Deductible. How much you can claim. You can obtain these publications free of charge by calling 800-829-3676.

However cash donations can only claim up to 250 and the taxpayers must provide a bank account statement or a payroll deduction to claim the tax deduction. Available online on the web or download the ItsDeductible in the App Store for on-the-go donation tracking. Ad Looking for tax deductible donation receipt.

You can deduct up. Shares valued at 5000 or less. What is a Donation ReceiptTax Receipt.

You should have a statement that you are a 501c3 charity. Gift types requirements and valuation rules. You should include a sentence like this.

It serves as proof that the donor has made a donation to a charitable organization and can be used to receive a tax-deduction by the IRS. From 1 Jan 2011 all individuals and businesses are required to provide their identification number eg. A Donation Receipt sometimes called a tax receipt is a formal written statement from a qualifying nonprofit which acknowledges they received a donors donation.

You would claim up to your amount of taxable income and your spouse or partner would. Instructions for Form 1040 Form W-9. You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions.

Use our free template to create a simple quick and professional receipt. Request for Taxpayer Identification Number TIN and Certification. The key distinction to make is that without an official written acknowledgment donors cant claim a tax deduction for their donation.

Content updated daily for tax deductible donation receipt. This donation is tax deductible and the deduction will be automatically. Tax Deductible Donation Receipts We have prepared examples of tax donation receipts that a 501c3 organization should provide to its donors.

This receipt is for your retention. 3333 of your taxable income. 3333 of your total donations.

Donating recently purchased property to a DGR. TurboTax ItsDeductible makes it easy to track your charitable donations so you get the biggest tax deduction possible. Gift types and conditions.

Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases. Individual Tax Return Form 1040 Instructions. NRICFINUEN when making donations to the IPCs in order to be given tax deductions on the donations.

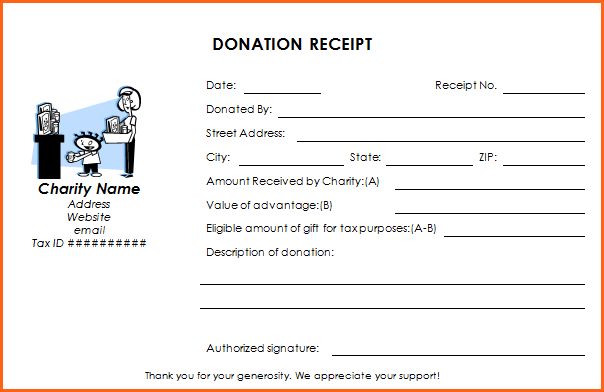

On your receipt you should have your organizations name address and EIN Tax ID. A tax deduction receipt should contain or incorporate the following. Get the most from your charitable contributions anytime.

How To Fill Out A Donation Tax Receipt Goodwill Nne

Why How And When To Issue Charitable Donation Receipts

Mastering The Donation Receipt Steal These Invaluable Tips Must Have Elements Templates By Miles Anthony Smith Medium

Four Steps To Making Your Charitable Donation Eligible For A Deduction The Scarletredish Rack

Tax Receipt Sweet Cheeks Diaper Bank

Tax Deductible Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Rece Receipt Template Letter Template Word Donation Form

Free Goodwill Donation Receipt Template Pdf Eforms

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Posting Komentar

Posting Komentar